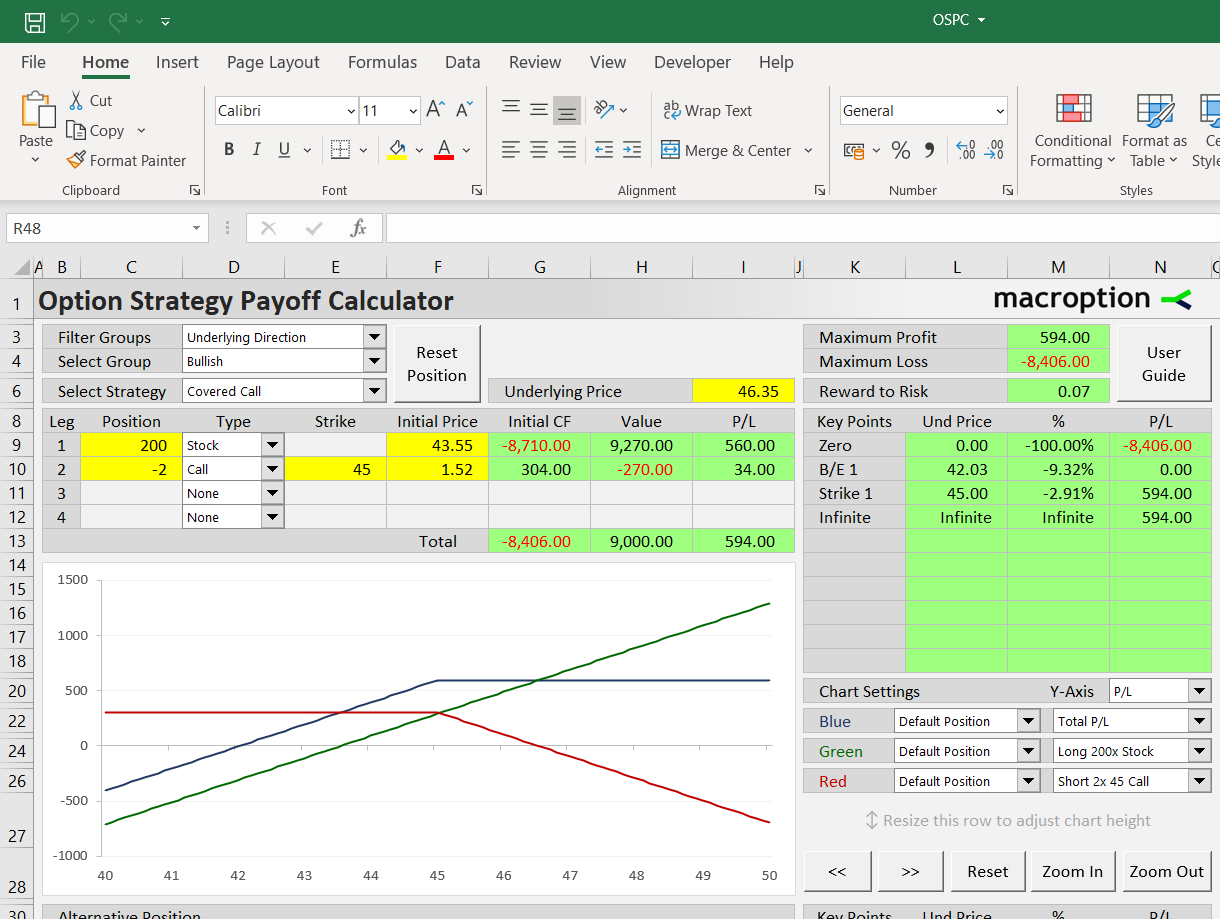

40 short call payoff diagram

According to the Payoff diagram of Long Call Options strategy, it can be seen that if the underlying asset price is lower then the strike price, the call options holders lose money which is the equivalent of the premium value, but if the underlying asset price is more than the strike price and continually increasing, the holders’ loss is decreasing until the underlying asset price reach the ... The short call option was an AAPL 125 strike call sold for $2.60 per contract or $260 in total. The breakeven price at expiration is $127.6 (strike price plus the premium received). The blue line shows the expiration payoff that you are now familiar with and the purple line shows what is known as a “T+0” line.

Profits are earned until the short call line crosses the horizontal axis, which is the stock price at which the strategy breaks even. In this example, the break ...

Short call payoff diagram

Short call is one of the option trading strategies which means selling or writing a call option.The strategy generates net credit in the beginning as the premium is received for writing a call. The trader has the obligation to buy the stock at the predetermined price at the time of options expiration.It is also known as naked or uncovered call as the trader does not own the underlying assets ... This page explains put option payoff. We will look at: A put option’s payoff diagram; All the things that can happen with a long put option position, and your profit or loss under each scenario; Exact formulas to calculate put option payoff; Calculation of put option payoff in Excel; Calculation of a put option position’s break-even point (the exact price where it starts to be profitable) Payoff Diagram: Impact of Options Greeks: Delta: Short Call will have a negative Delta, which indicates any rise in price will have a negative impact on profitability. Vega: Short Call has a negative Vega. Therefore, one should initiate Short Call when the volatility is high and expects it to decline.

Short call payoff diagram. The payoff diagram of a short call position is the inverse of long call diagram, as you are taking the other side of the trade. Basically, you multiply the profit or loss by -1.. For detailed explanation of the logic behind individual sections of the graph, see long call option payoff.. Short Call Payoff Formulas. The formulas are the same as those for long call option strategy, only the ... Selling a Call Payoff. When we reverse the position and sell a call option, here is the payoff diagram for that. We have the same format of stock price on the x-axis (horizontal) and P&L on the y-axis (vertical). Because we sold the call, we receive money for the sale, which is the premium. Payoff Diagram. Short calls have a similar shaped payoff diagram to a long put. Profits are flat below the strike price with a breakeven price equal to the strike price plus the premium. Above the breakeven price, losses accrue on a one to one basis with a move higher in the stock price. A short call is a strategy involving a call option, giving a trader the right, but not the obligation, to sell a security. It usually reflects a bearish ...

Short call payoff per share = (premium per share - (MAX (0, (share price - strike price)) Long Put Options Donna has just returned from a major apparel company's fall showing; she was not impressed. Short put: sellers of put options hope the stock price to go up or stay around current levels.If the asset price decreases, options sellers are obliged to buy shares at a predetermined price (strike). A seller of a put option receives a premium, that is, the profit potential is limited and known in advance, while risks are conditionally unlimited. Payoff Diagram: Impact of Options Greeks: Delta: Short Call will have a negative Delta, which indicates any rise in price will have a negative impact on profitability. Vega: Short Call has a negative Vega. Therefore, one should initiate Short Call when the volatility is high and expects it to decline. This page explains put option payoff. We will look at: A put option’s payoff diagram; All the things that can happen with a long put option position, and your profit or loss under each scenario; Exact formulas to calculate put option payoff; Calculation of put option payoff in Excel; Calculation of a put option position’s break-even point (the exact price where it starts to be profitable)

Short call is one of the option trading strategies which means selling or writing a call option.The strategy generates net credit in the beginning as the premium is received for writing a call. The trader has the obligation to buy the stock at the predetermined price at the time of options expiration.It is also known as naked or uncovered call as the trader does not own the underlying assets ...

#UmbertoEco The Alchemy of Light: Geometry and Optics in Late Renaissance #Thenameoftherose #Foucault's_Pendulum" #umbertoeco What does the Squared Pavement Symbolize?The All Seeing Eye

The Sorrowing Angel (1901) // Sir Frank Short (English, 1857-1945) after George Frederic Watts (English, 1817-1904)

Saint Martin and the Beggar (about 1597–about 1600) // El Greco (Doménikos Theotokópoulos) Greek, active in Spain, 1541–1614

The Assumption of the Virgin (1577–79) // El Greco (Doménikos Theotokópoulos) Greek, active in Spain, 1541–1614

The Feast in the House of Simon (about 1608–14) // El Greco (Doménikos Theotokópoulos) Greek, active in Spain, 1541–1614

0 Response to "40 short call payoff diagram"

Post a Comment